jangkrik.online

Tools

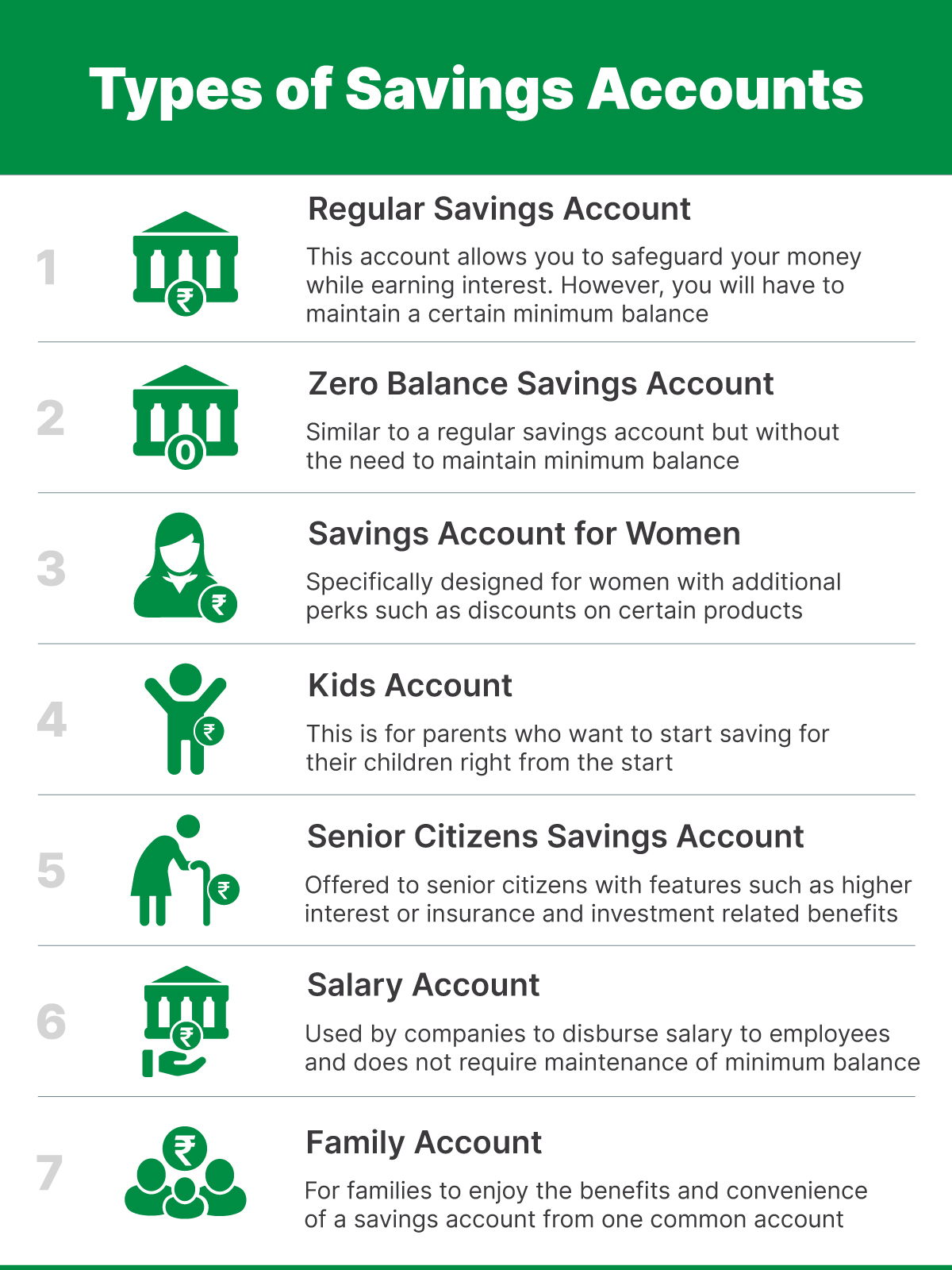

Large Deposit Savings Accounts

Certificate of Deposit. A Certificate of Deposit (CD) account is a low risk, high-rate savings account option with fixed rates and term lengths. An. Think of it as a journey that unfolds step by step, one deposit and interest payment at a time. Ready to get started? Our savings accounts1 are designed to make. Many banks now offer high-yield savings accounts with rates above %. That's far above the average rate of a traditional savings account: currently %. Money market accounts require higher balances, typically offer higher interest rates, and provide the flexibility of writing checks to access your funds. Meet. Savings Account Benefits Worth Celebrating · Earn up to % APY* · Only $ to open · Make unlimited deposits. High-yield savings accounts are great for building emergency funds, saving for big purchases and long-term goals or a safe account for your retirement funds. A. Unlike other types of high interest savings accounts, you can write checks from your money market savings account. With the Fifth Third Relationship Money. A high-yield savings account (HYSA) is very similar to a traditional savings account, but a HYSA gives you the opportunity to earn a higher yield — meaning your. A high-yield savings account offers much higher interest rates on your money than a traditional savings account – maybe more than 10 times more. Some high-yield. Certificate of Deposit. A Certificate of Deposit (CD) account is a low risk, high-rate savings account option with fixed rates and term lengths. An. Think of it as a journey that unfolds step by step, one deposit and interest payment at a time. Ready to get started? Our savings accounts1 are designed to make. Many banks now offer high-yield savings accounts with rates above %. That's far above the average rate of a traditional savings account: currently %. Money market accounts require higher balances, typically offer higher interest rates, and provide the flexibility of writing checks to access your funds. Meet. Savings Account Benefits Worth Celebrating · Earn up to % APY* · Only $ to open · Make unlimited deposits. High-yield savings accounts are great for building emergency funds, saving for big purchases and long-term goals or a safe account for your retirement funds. A. Unlike other types of high interest savings accounts, you can write checks from your money market savings account. With the Fifth Third Relationship Money. A high-yield savings account (HYSA) is very similar to a traditional savings account, but a HYSA gives you the opportunity to earn a higher yield — meaning your. A high-yield savings account offers much higher interest rates on your money than a traditional savings account – maybe more than 10 times more. Some high-yield.

Risk-free savings: High yield savings accounts come with a level of predictability, with a set (but variable) interest rate on all deposits. Funds are FDIC-. Most high-yield savings accounts don't offer ATM cards, so incoming and outgoing money transfers happen via electronic transfer or mobile check deposit. Who. Please note: The terms "bank" and "banks" used in these answers generally refer to national banks, federal savings associations, and federal branches or. Our savings accounts · Truist One Savings · Truist One Money Market Account · Truist Certificates of Deposit · Truist Confidence Savings. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. Maximize your money with our high-yield online savings account that offers great interest rates, no fees and no required balance or minimum deposit. An interest-bearing savings option for those with larger savings balances. Minimum Opening Deposit. $ $ $ $25, Monthly Service Fee. A High-Yield Savings Account from Axos Bank offers a high APY with free online banking, no monthly fees, and interest compounded daily. The current mobile daily deposit limit is $2, per account. Note: Please ensure to endorse the back of the check. Direct deposit from a third party, for. Get the added protection of the Federal Deposit Insurance Corporation (FDIC). Savings accounts at U.S. Bank are FDIC-insured to the maximum amount allowed by. A high-yield savings account (HYSA) is a savings account that pays a higher interest rate than traditional savings accounts. Fortune Recommends: UFB Direct offers a high-yield savings account with a % APY along with no minimum opening deposits or monthly maintenance fees. Since. If you have extra cash to stash away—either for an emergency or as the beginnings of a nest egg—a high-yield savings account can be a great option. If you're looking for the best rate for your savings, high-yield savings accounts typically offer yields that pay many times the national average. Maximize your money with our high-yield online savings account that offers great interest rates, no fees and no required balance or minimum deposit. A savings account is a type of deposit account offered by financial institutions like banks and credit unions. Customers can hold cash in a savings account and. Earn up to % APY · Deposit accounts FDIC insured up to $K individual and $K joint · Accounts · UFB Additional Services · Mortgages · Financial Resources. Make your savings work harder. % Annual Percentage Yield (APY). · Discover a more convenient way to save. · $0 monthly account maintenance fees · Deposits are. Use our High Interest Savings account to earn up to % APY on balances up to $2, No matter which free savings account you choose, you'll enjoy the.

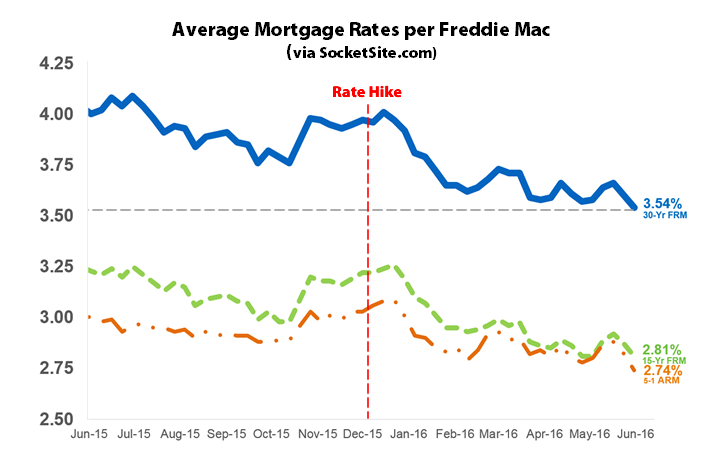

Benchmark Mortgage Rates Today

Refinance Loan Calculator. Current Loan Amount $. Interest Rate %. Current Term months. Origination Year. New Loan Amount $. New Interest Rate %. New Loan Term. Today's competitive rates† for adjustable-rate mortgages ; 10y/6m · % · % ; 7y/6m · % · % ; 5y/6m · % · %. Our Handy Mortgage Calculators. Free, easy, intuitive. What does your monthly payment look like? Purchase Price $ Mortgage Term 30 Years 25 Years 20 Years Home Loans are provided by your dedicated team at Benchmark Mortgage, helping clients all across the Pacific Northwest fulfill their dream of home. Estimate your monthly financial commitment with our mortgage payment calculator. Plan wisely for your home today. Input your details to try it now. Today's Commercial Mortgage Rates ; BANK, % ; AGENCY, % ; AGENCY SBL, % ; CMBS, % Today's average rate for the benchmark year fixed mortgage is , the average rate for a year fixed mortgage is percent, and the average 5/1 ARM. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-rate mortgage: Today. The average APR on a year fixed. As of Sept. 9, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Refinance Loan Calculator. Current Loan Amount $. Interest Rate %. Current Term months. Origination Year. New Loan Amount $. New Interest Rate %. New Loan Term. Today's competitive rates† for adjustable-rate mortgages ; 10y/6m · % · % ; 7y/6m · % · % ; 5y/6m · % · %. Our Handy Mortgage Calculators. Free, easy, intuitive. What does your monthly payment look like? Purchase Price $ Mortgage Term 30 Years 25 Years 20 Years Home Loans are provided by your dedicated team at Benchmark Mortgage, helping clients all across the Pacific Northwest fulfill their dream of home. Estimate your monthly financial commitment with our mortgage payment calculator. Plan wisely for your home today. Input your details to try it now. Today's Commercial Mortgage Rates ; BANK, % ; AGENCY, % ; AGENCY SBL, % ; CMBS, % Today's average rate for the benchmark year fixed mortgage is , the average rate for a year fixed mortgage is percent, and the average 5/1 ARM. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-rate mortgage: Today. The average APR on a year fixed. As of Sept. 9, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %.

Mortgage Rates Are Dropping. Now's the Time to Act! Whether you're buying a new home or looking to refinance your current mortgage, Benchmark FCU has you. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Home Loans are provided by your dedicated team at Benchmark Mortgage, helping clients all across the Pacific Northwest fulfill their dream of home. rates increasing rapidly. Why Contact our team today and let's discuss your home buying options. Mortgage Rates Remained Flat This Week. September 5, Mortgage rates remained flat this week as markets await the release of the highly anticipated. View current and personalized mortgage rates and explore the benefits of financing your home with PNC. Estimate your monthly financial commitment with our mortgage payment calculator. Plan wisely for your home today. Input your details to try it now. rate loan today is %. We are a half point lower than that national average! Buyers do not need to wait for these rates - they can get them NOW! Give us. This loan calculator will help you determine the monthly payments on a loan. In the same period last year, the rate on a year benchmark mortgage was %. “Mortgage rates fell again this week due to expectations of a Fed rate cut,”. View current loan and savings rates at Benchmark Federal Credit Union Rates are subject to change & based on an individual's credit history. Mortgage Rates. We offer a variety of home loans, including fixed-rate and adjustable rate mortgages. We also offer refinancing for those wishing to consolidate loans. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. Please use the dropdown above to select your current situation. The Rates and fees subject to change. In accordance with Section of the USA. Calculated from actual locked rates with consumers across 35% of all mortgage transactions nationwide, OBMMI includes multiple mortgage pricing indices. Check out these rates! Wow! According to Bankrate. com, the national average for a 30 year fixed rate loan today is %. We are a half point lower than. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Please use the dropdown above to select your current situation. The Rates and fees subject to change. In accordance with Section of the USA. View current and personalized mortgage rates and explore the benefits of financing your home with PNC.